EIN number plays a vital role in your business setup to-do list.

When you open a business in the US, you want to complete all required actions. Don’t you?

An important step is to get an employer identification number (EIN).

You can do this easily.

If you like numbers, this post is definitely for you. If not, it will at least help you get your business ID number.

The EIN number is just a piece of your incorporation puzzle. To get the big picture, check out how to incorporate your startup in the US.

You will now discover the following:

What is EIN Number?

The EIN is a taxpayer identification number (TIN).

The EIN is also called a federal tax ID number, IRS tax number, business tax ID, EIN number, or FEIN – all the same thing.

Applied to companies, the EIN is just like your personal social security number (SSN).

At the same time, do not confuse the EIN with an individual taxpayer identification number (ITIN). The latter we’ll cover in a separate post.

Issued by the IRS, the EIN is a 9-digit number that identifies your company.

Why Get EIN?

Unlike what it sounds, the EIN is not only for employment purposes. In fact, your company will need a federal tax ID number for various reasons, even if the company has no employees. The EIN, for example, is necessary to:

- Start a business;

- Purchase a going business;

- Open a bank account;

- Comply with the IRS withholding regulations to benefit from a US income tax treaty;

- Withhold taxes on income paid to an alien;

- Operate an S corporation or single-member LLC;

- Change type of organization;

- Hire employees;

- Create a trust; and

- Effect other actions.

How to Apply for Federal Tax ID Number?

To get a tax ID number, you can apply online, by phone, fax, or mail. Application is free.

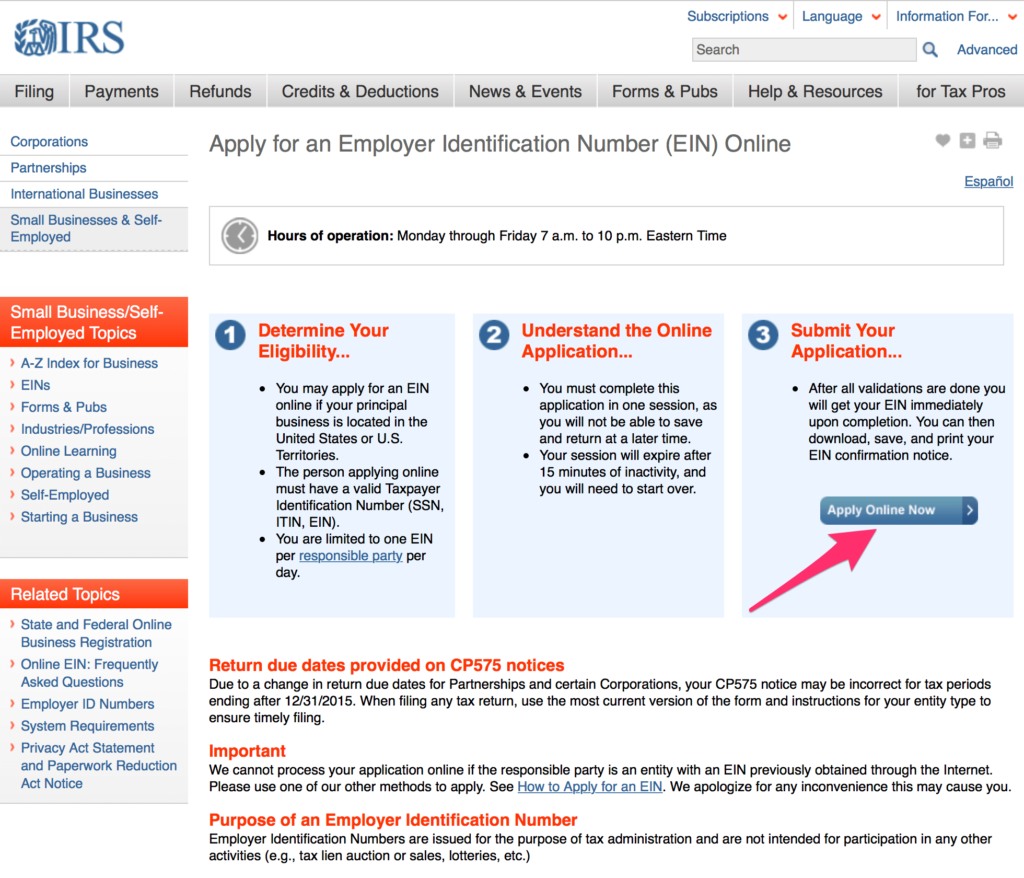

The easiest way is to apply for the EIN online. First, go to the IRS webpage, read the instructions, and click “Apply Online Now” as shown here:

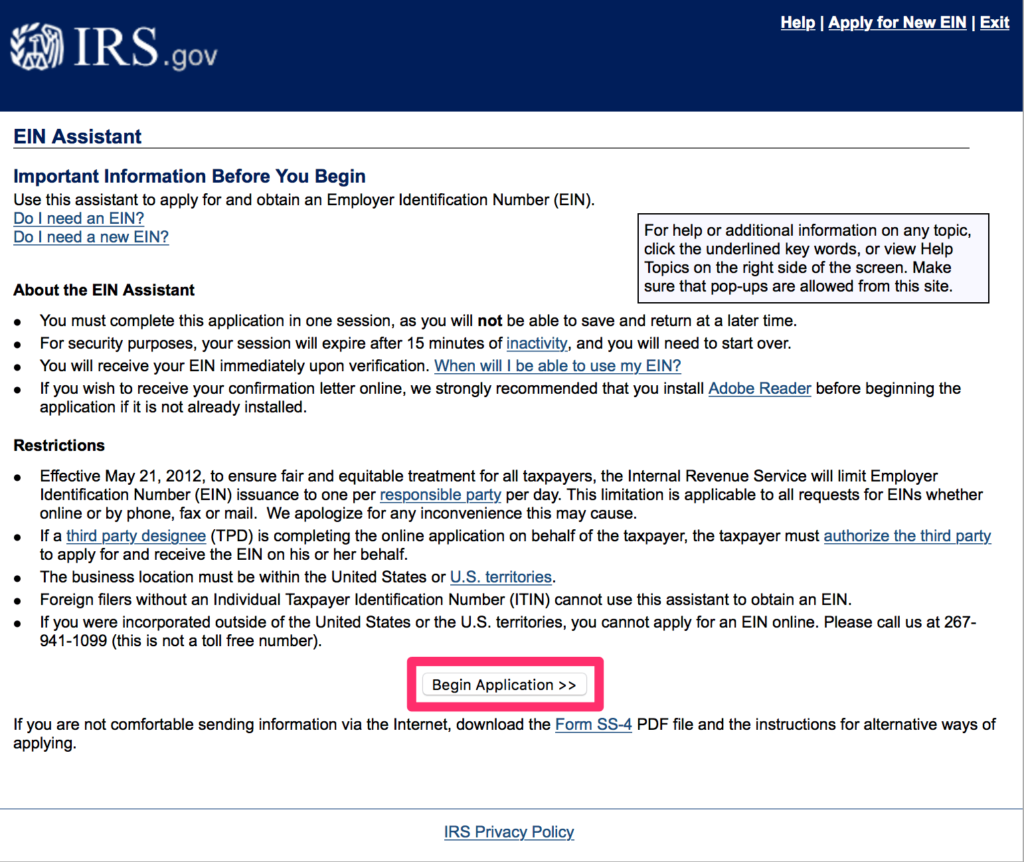

Then, review further instructions and click “Begin Application” as demonstrated here:

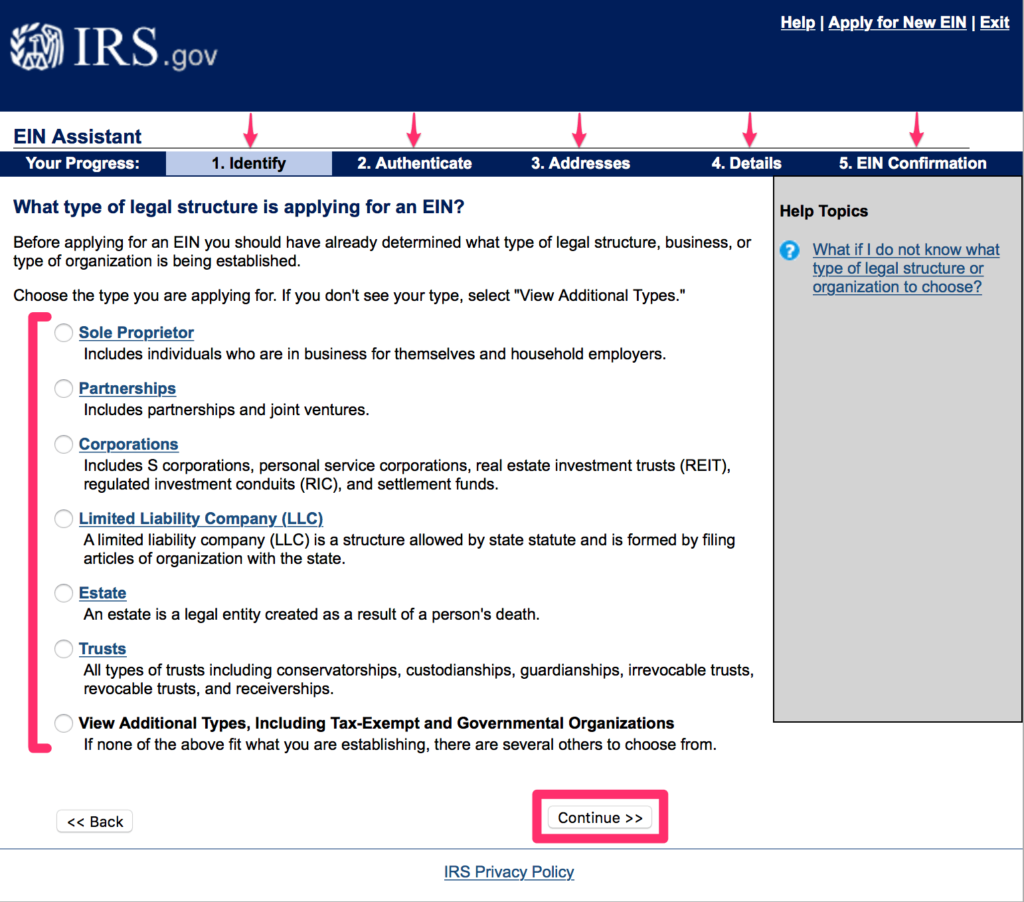

Finally, fill out the required fields with relevant information, including your SSN/TIN, company form, tax classification, and other details as follows:

The best part? You get your business tax ID number right away.

How Can Foreigners Get EIN?

Online application, however, is not available to foreigners having no SSN or TIN. That’s because the online system requires to fill in the required field of SSN/TIN.

Foreign businesses, at the same time, need an EIN, for example to file the US tax form W-8 and/or get the US tax treaty benefits.

So, foreigners who start a businesses in the US and have no US tax number ask a common question: Is it possible to get a federal tax ID number without SSN or TIN? If so, how to get an EIN number?

First, foreigners can get an EIN. In other words, it’s possible to get a federal tax ID number even if foreign founders/managers of a US company have no SSN, TIN, or any other US ID number. Second, while not online, it’s possible to get an EIN by other means.

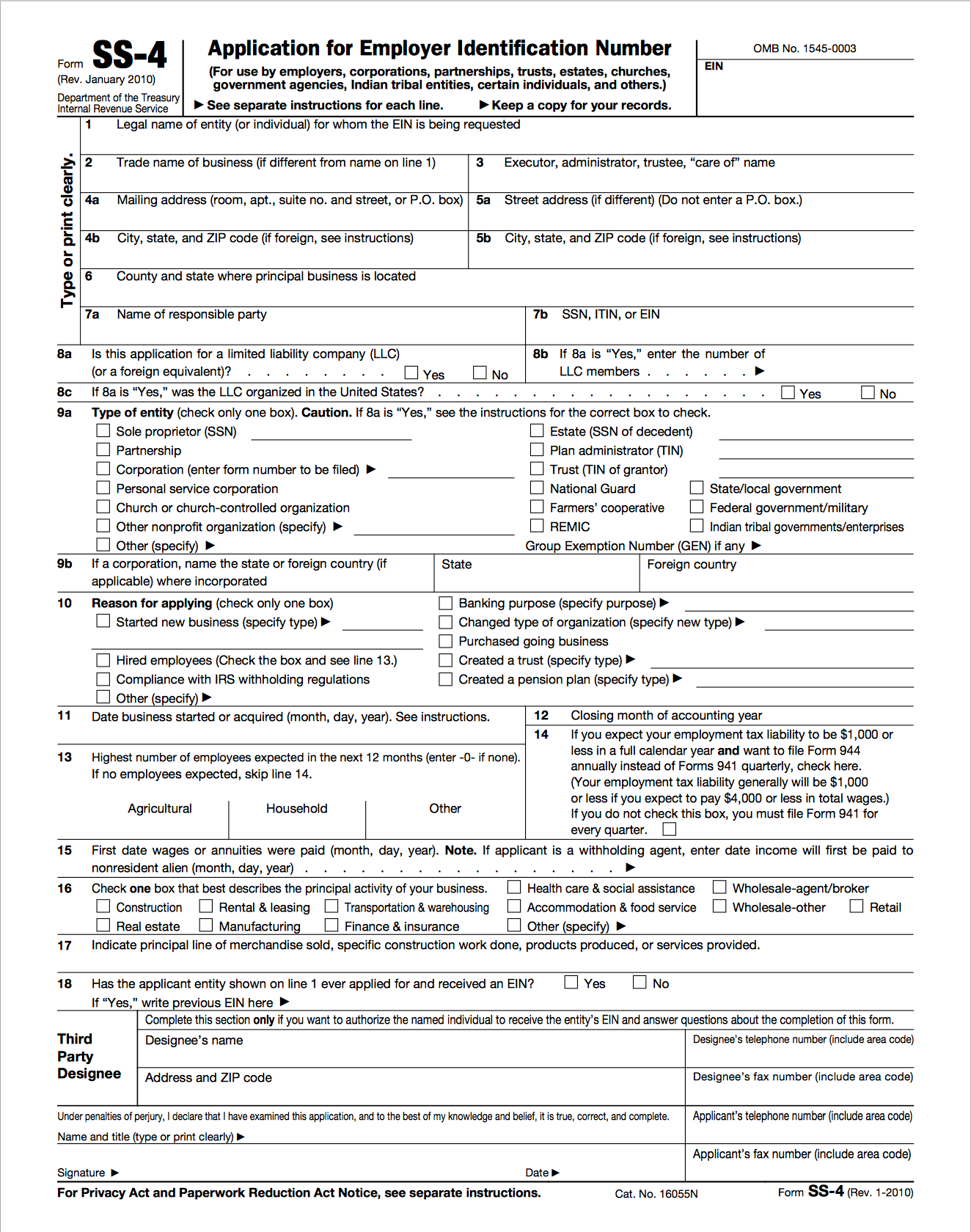

In this case, you can use the IRS Form SS-4 shown here:

How can you actually use the SS-4 Form? Fill out relevant details and fax/mail the form to the IRS.

Be careful with your answers, though. To succeed, make sure to complete all details properly.

Authorized Designee

You can apply for EIN either by yourself or via your authorized representative. You can, in particular, designate an attorney to represent you before the IRS.

As a result, you get an IRS notice specifying your federal tax ID number.

Once done, check off the EIN step in our business setup checklist.

Having obtained your company EIN, you can open your business bank account in the US.

Alongside, remember to complete other important business setup actions, for example, to register your trademark.

For an ultimate guide on how to open your business in the US, watch our webinar.

Should you have any questions or comments, feel free to contact us.