Opening a US business bank account allows you to multiply your money.

Starting your IT business in the US?

Wish to get, keep, and invest your money on US bank account?

Want to open a bank account remotely (online)?

If so, consider opening a business account with American bank.

US Bank Account Benefits

Having opened your US business bank account, you can:

- Unlock gateway to seamless business operations in America;

- Avoid high currency-exchange fees of online payment systems;

- Get SWIFT and routing numbers of US bank;

- Obtain a free bank account access (even without a monthly maintenance fee);

- Enjoy online banking on your mobile, laptop, and desktop right away;

- Receive business debit cards for any corporate purchases;

- Deposit money into your business bank account;

- Accept payments (wire transfers) in US dollars from American and other clients all over the world;

- Make electronic payments (ACH debit);

- Receive incoming domestic and international wires;

- Send outgoing domestic and international wires;

- Open merchant accounts with PayPal Business, Stripe, and other payment gateways;

- Transfer money from accounts with Payoneer, Wise (former TransferWise), Revolut, Brex, and other online payment systems;

- Open an Amazon business account;

- Take your IT venture to the next level;

- Get checkbook and deposit checks via mobile banking app; and

- Open a corporate credit account and get a credit card to build your credit history.

This is why opening a US business bank account is so important in 2025.

Business Bank Account

Starting an American business necessitates opening a business bank account (aka corporate account) in the US.

Opening a business bank account is, in turn, one of the reasons for you to register a company in the US in the first place.

As you likely know, business account allows your company to receive and pay money for your business activities. It’s also a handy tool for your internet banking.

Besides, your commercial account is a safe place to keep your enterprise money. Notably, the US bank accounts are FDIC insured for $250,000.

What accounts can you expect to open in the US?

Types of Accounts

There are 3 main types of accounts:

- checking account;

- savings account; and

- credit account.

Each account has its own designation. The checking account is your main business account. You can use it to receive payment for your goods or services as well as pay for goods and services of others.

The savings account, in turn, is essentially your deposit account. It saves your money in a separate place. The savings account can also earn you a bit of interest.

Finally, the credit account is your backup account. Should your business need some extra funds, you can borrow them via your credit account. It can thus provide you a financial cushion.

Credit History

Having opened a credit card account, you can build your credit history. This is a big deal. Very few people, nonetheless, understand the essence of credit history in the US. Even fewer realize its importance.

As a matter of fact, your credit history is probably the most important factor in determining your chances to get a loan in the US. Your credit history largely determines whether a bank would grant you a loan and, if so, on what terms, especially the interest rate. Surely, the higher your credit rating (on a scale of up to 850 points), the better off you are.

Small Business Accounting

Your US business bank account is very useful not only for your money keeping, but also for your small business accounting. Your business account can, in particular, facilitate your financial and tax reporting.

Using your bank account statements, for example, your CPA can run over your transactions, determine your tax liabilities, and then file your US tax returns and forms.

American Banks

There are many American banks for you to choose from. They range from small local to large international banks. Some of the most popular are Bank of America, Chase Bank, Citibank, HSBC, Wells Fargo, TD Bank, Capital One, etc.

Not all banks are created equal. It’s important to find a good fit for your needs. Consider factors like business banker relationships, corporate ownership structure, physical presence in the US, online banking capabilities, transaction fees, and customer support.

Which bank can provide you the best business bank account?

As you might guess, it depends. Each bank has its own advantages. Some focus on the US market, offering a wide network of branches and ATMs around the states. Others operate internationally and have branches in Europe, Middle East, Asia, and other regions of the world.

Few US banks might even provide some of the best bank accounts you can open online (remotely). This can make it easier than ever to open business account online from anywhere in the world.

Still wondering which bank is best? For your reference, check out the largest US banks here. Depending on your circumstances, we can consider which banks may fit you well. At the end of the day, the choice is yours.

By the way, which of the following banks would you prefer?

Upon your vote, you’ll discover how your preference compares with others’ here.

Business Banking Policies

Banks have their own policies for opening business bank accounts. Those policies can vary significantly. For example, banks have different rules on opening business accounts.

Regardless of their policies, however, every American bank must comply with strict federal and state regulations that protect your money. This is your cornerstone safeguard.

If a bank’s policy fits you well, find out its account opening requirements, options, and procedures. For instance, check if you may apply for bank account online (without a personal visit to a US bank).

Online Bank Account

In the past, some US banks used to open business accounts online. This means that an individual did not have to visit the bank. Opening US business account remotely is especially handy for nonresidents living outside the US.

Such a remote account opening covered both personal and business accounts. In this connection, opening a corporate account remotely required an incorporation or registration in a certain state.

That remote account opening practice is no longer common, however. Instead, American banks now normally require a physical presence in the bank when opening the first account. Having opened your first account physically, nevertheless, you may be able to open your subsequent accounts online.

Still need to open a US bank account online?

While personal presence is normally required, it may, under certain conditions, be possible to open a bank account remotely. Such an online bank account — either personal or business — might, for example, be openable if you deposit over $100,000. Such a deposit may serve as your online savings account in America.

As you can see, online account opening still works in the US. Hurry up to use this rare opportunity as it may end soon (if not yet).

Setting up your account is quite quick. Visiting a US bank to open business and personal bank accounts can take just less than an hour, provided everything is prepared well in advance.

During your visit to open an account, an American bank provides an access to its online banking, including a mobile app. Online banking service is normally free and user friendly. So, you can efficiently operate your accounts from your laptop, tablet, or smartphone anywhere in the world. This is highly convenient.

Online Account Opening Scams

You may encounter numerous providers who offer to open bank account online (remotely). Beware, however, that some of them may turn out to be a scam.

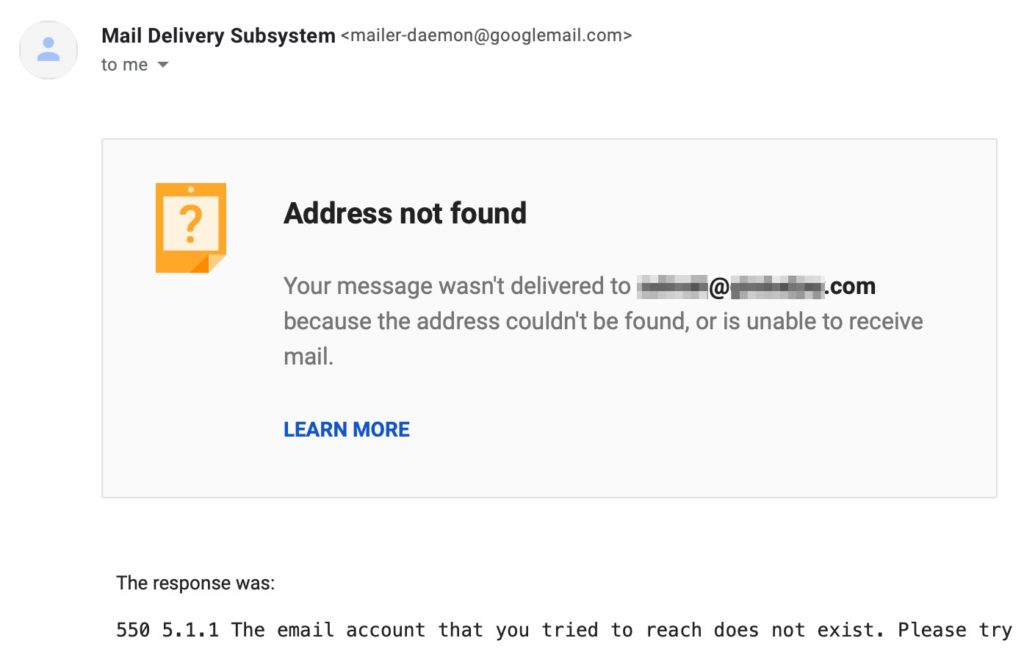

Many entrepreneurs all over the world want to open business account online. At the same time, make sure to check the legality of such account opening. When you ask providers whether opening business account in Bank of America online would actually be legal, they occasionally disappear. In response to your inquiry, for example, you may get the following auto-response:

This response doesn’t look to be promising. Does it?

In this case, the recipient’s email address cannot be misspelled where you simply hit “Reply” in her previous email thread. So, the email address suddenly disappeared just because of inquiry into service legitimacy.

Even if someone opens a bank account online (remotely), this may be illegal (in violation of the bank policy). In such a case, the bank may close the account at any time. This may happen even right after opening the account. Also, the bank would highly likely not explain the reason why it closed the account.

As you can tell, selecting and verifying the right banking service provider is crucial. Before you spend a few thousand dollars opening your US business bank account, make sure to conduct a legal due diligence on the service provider. Otherwise, you may lose your money.

It’s important to entrust your financial matters to professionals with high reputation. This, for example, includes US-qualified lawyers or law firms. At the same time, avoid companies having no professional license.

Opening Corporate Account

As noted above, before opening an account, American banks want account owners to come to the bank. In other words, a personal visit of a responsible party (i.e., owner and/or manager) is usually a must.

If visiting an American bank is a challenge for you, it might be possible to work out a solution. It would, though, depend on your particular circumstances. For instance, you may designate another corporate stakeholder to visit the bank. That’s practicable.

Besides, if you know any US bank opening accounts without a physical presence, please let us know. In such a case, we might be able to help you open your account with that particular bank remotely. So, you may not need to visit the American bank before opening a business bank account.

Which way would you prefer to open your US business bank account?

Once you vote, find out the total results right here.

Documents and Information

To open a business bank account, you need to follow an account opening procedure. First of all, a bank would request your passport, company EIN (federal tax ID number), US address, phone number, email address, and other details.

You would also need to provide constituent documents of your company incorporated in the US. These, for instance, include:

- Certificate of incorporation, bylaws, and shareholders’ agreement for corporation; or

- Articles of organization and operating agreement for LLC.

Additionally, a US bank may ask you to provide a filing receipt and top management appointment documents.

Furthermore, a bank may require you to provide a US taxpayer identification number (TIN) of banking signatory. It may, for example, be a social security number (SSN) for US residents or individual taxpayer identification number (ITIN) for nonresidents.

On top of all, the US bank may require you to provide contact details of a US person (citizen or permanent resident) being a business owner or controlling manager, as described below.

The bank manager would first consider your account opening application. The manager would then ask you questions about you and your business. So, prepare to answer in advance. Importantly, respond honestly and correctly.

US Person Requirement

The US banks normally require one of the business owners or controlling managers to be a US citizen or resident.

This US person requirement is understandable. First, American banks prefer to deal with local (rather than remote) business. Second, the physical proximity of the US person makes the American company more accountable. Third, American banks wish to have someone around to contact if a need arises. Differently put, the US banks need to avoid searching for someone across the globe.

Who are those corporate stakeholders (i.e., business owners or controlling managers) whom the US banks want to know?

First, a business owner, for instance, is a person who owns 25% or more of the equity interest in a legal entity. The ownership may be direct or indirect.

Second, a controlling manager is a person with significant responsibility to direct, manage, or control the entity. The controlling manager may, for example, be:

- Chief executive officer (CEO);

- President;

- Chief financial officer (CFO);

- Treasurer;

- Chief operating officer (COO);

- Secretary;

- Managing member; or

- Other individual performing similar functions.

US Contact Benefits

On one hand, you may treat the above US person requirement as a burden. This is particularly so if you as a nonresident wish to be the sole owner and manager of your US company. You may indeed be the single shareholder and director of your American company under the corporate law.

On the other hand, you may treat the US person requirement as your benefit. This is because the American contact person may perform useful roles for your US company. For example, an American resident may meet offline not only with the bank managers but also with your leads and clients in the US. This way, the US person may market and sell your products or services. Alongside, the local representative may help you develop your business way more efficiently. Moreover, the US person may attract investments into your business.

Isn’t that what you actually need?

Lack of US Person

As a matter of fact, we managed to open business bank accounts for American companies wholly owned by foreigners (nonresidents living outside the US) without any US person. Some of those companies still have no US person to date. Thankfully, banks occasionally provide exceptions to their policies, depending on their risk appetite.

Notwithstanding that, engaging a US person for your American company would be the best practice. This is for you to be on a safe side. Otherwise, there is a risk that the US bank will reconsider its compliance sensitivity against you. As a result, the bank may ultimately close your business bank account at any time. In this case, you may never find out the account closure reason.

As you can see, the more diligently you approach your US bank account opening and maintaining, the better off you will be.

Ideally, the US person should be your bank account signatory (signer). This normally works best for American banks. If this approach does not fit you well, nonresident signatory might still work as well, depending on your circumstances.

Bank Account Signatory

Last but not least, answer this crucial question: Do you want suddenly to lose all your money on your US business bank account? Of course, not!

To be on a safe side, never entrust your money access to any third party. For example, some providers offer to take a controlling manager position in your American company. In this role, they may act as your company signatory at the US bank. On one hand, this may look attractive. Such a signatory substitute may eliminate the need for you to visit the US to open a bank account.

On the other hand, the account opening service may simply turn out to be sham. In no time, you may lose all your money if the person transfers it somewhere and disappears. Strikingly, can you imagine how many accounts such a controlling manager may “manage”? His/her temptation to defraud you may hence be huge.

So, never risk losing your money due to someone else. Ideally, be the controlling manager. Access and operate your money only by yourself. This wisdom may help you avoid plenty of worries and frustrations.

As a rule of thumb, if somebody (even a lawyer or accountant) offers you to act as your company controlling manager, beware. Engage only reputable professionals.

As a matter of fact, we frequently receive requests to open a US business bank account remotely. People, particularly, ask us to act as a bank account signatory or representative under power of attorney. Although we could easily do that, we warn that such a substitute signatory practice is generally risky from a legal perspective. Instead, we advise clients to open US business bank accounts safely.

Besides, a power of attorney may actually not work for opening a bank account. It may rather work afterwards (once you get a bank account number) for account operation and maintenance.

Now, whom would you prefer to be a signatory (signer) for your US corporate bank account?

Once you vote, check out what others prefer right here.

Account Opening Timeframe

How quickly can you open a US business bank account?

It depends. If you have everything and everyone ready, it can happen swiftly — even as fast as within an hour. If you miss something, however, opening a checking bank account may take from a few days to several weeks or even months.

The time to open a bank account largely depends on how well you prepare all necessary documents, information, and signatory. Obviously, the higher the readiness, the shorter the timeframe. Thus, plan the account opening timing well in advance.

US Banking Experience

American banks widely differ in how they approach business clients. Furthermore, even managers in one bank may treat certain things differently. This lack of uniformity may affect your experience with US banks.

Now, it’s your turn to share your experience. Which American banks do you work with? Do you know a real (physical) US bank that opens business accounts remotely? Just leave your comment below.

Open US Business Account

Don’t let banking hurdles hold you back. Create business account online with confidence and unlock the full potential of your US IT business.

If you know US banking rules and practices on how to open a business bank account, you can open an American bank account on your own (especially, if you live in the US).

At the same time, to boost your chances to succeed, consider engaging an attorney or other qualified professional. This is especially relevant when opening an online business account if you (as a non-US resident) live outside the US.

We, for example, can help you with all steps, such as:

- Find a suitable American bank;

- Coordinate legal issues with bankers;

- Answer bank’s questions;

- Prepare necessary documents;

- Fill out requisite forms;

- Submit required documentation; and

- Get account opening approval.

This can be quick, convenient, and hassle-free.

To get help with opening your US bank account, feel free to contact us.

Дмитрий!Это возможно открыть счет или карту в США дистанционно?

И другой вопрос: могли бы вы рекомедовать виды бизнеса, если я нахожусь в Казахстане и хотела бы наладить торговые связи с США?

Алла, спасибо за Ваше обращение!

1. Ранее было возможно открыть банковский счет и карту в США дистанционно (онлайн). Сейчас же американские банки, как правило, требуют личное присутствие владельца при первом открытии счета.

При этом в некоторых случаях (например, при внесении более 100 тыс. дол. США) все-таки можно открыть счет дистанционно (онлайн).

Открыв один счет, последующие (дополнительные) счета в том же банке обычно можно открывать дистанционно через интернет-банкинг (например, мобильное приложение банка).

2. Виды бизнеса клиенты рассматривают и выбирают сами. Мы же предоставляем юридические услуги. Например, можем помочь Вам:

– создать американскую компанию;

– подготовить контракты и корпоративные документы;

– подключить виртуальный офис на Уолл-стрит в Нью-Йорке;

– получить федеральный налоговый ID;

– открыть корпоративный банковский счет;

– зарегистрировать торговую марку; и

– осуществить другие действия в США.

Дмитрий, подскажите.

Какого характера задают вопросы в банке, во время открытия счета.

Юрий, спасибо за вопрос.

При открытии корпоративного счета в США менеджеры американского банка могут ставить любые вопросы, связанные с бизнесом американской компании, например:

– кто владеет и управляет компанией;

– какие виды деятельности компания будет осуществлять;

– какой оборот планируется от деятельности компании;

– какие способы расчетов будут применяться; и

– другие вопросы.

In this particular blog you will get to know about the open bank account. This article is very helpful and interesting. I enjoyed reading this article as it provided me lots of information regarding it. You will get best review over here and would suggest others too. Great blog indeed, will visit again future to read more!! I have also found this resource useful and its related to what you are mentioning.

Thanks for your feedback!

We will be happy to help you open a US business bank account (even remotely).

By Reading your Blog, I finally came to Know about Checking Account.

I wanted to Open a Account for my business, but I’m from India.

Thanks for your feedback, Raj.

We are happy that our post helped you learn about American banking.

As a non-US resident, you can still open a US business bank account, even remotely (online).

If you need help opening a corporate account for a foreign-owned American company (LLC or corporation), please feel free to contact us.

Good luck with opening your US business account in 2021!

Hello Dmytro,

I’m from India, I’m doing business with USA.

I wanted to Open a Account for my business, but I’m from India.

Can you help me to get an account.

Hi Saravanan, thanks for your inquiry!

We would be happy to help you open a US business bank account.

We have already emailed you information on opening a US bank account.

Hello,

we are interested in opening a US bank account for LLC. Could you please provide us more info?

Hi Arjariya, thanks for your interest.

We’ve already emailed you about our legal services for opening a US business bank account, including an option without visiting a US bank (remotely).

HI Dmytro

After reading through your website and understanding that to open a bank account remotely is not possible, however I see in the messages above that you are offering this service. Please advise further. We do not have a foreign owned American company we would have to register an LLC. We have a business in South Africa exporting to all the major countries worldwide.

Hi Trish, thanks for your comment and question.

As we noted in the post above, personal presence is normally required to open a US business bank account. At the same time, it may, under certain conditions, be possible to open a US bank account remotely. Such a practice, however, is more of an exception than a rule.

Good luck with your American account opening!

Hi. I have registered company in USA but I want to open a bank account in USA. Anyone can help me?

Hi Ayub, thanks for your inquiry.

We’ve already emailed you information on our legal services to open a US business bank account.

Good luck with your American corporate banking!

Hi,

We are a corporation in US owned by US non residents.

Can you open a bank acc for this company? And what can be a price for this acc.?

Hi Karen, thanks for your inquiry.

We’d be happy to help you open a business bank account in the US (perhaps, even remotely, depending on your circumstances).

We’ve been successfully opening American corporate accounts so far.

As requested, we’ve already emailed you the details.

I have a USA LLC and EIN. Could you please help in opening a Business Bank account. I am a non resident. I can not visit USA

Hi Satheesh,

Thanks for your inquiry.

Check your inbox for our email about opening a US business bank account (possibly, even remotely).

Good luck!

I have EIN , LLC papers and need to open a business checking ac in USA ( Online only )

Please share me details jillisrael111@gmail.com

Hi Jill,

Thanks for your inquiry.

As requested, we’ll email you our legal service info on opening a business bank account in the US (including an online option).

Take care!

I formedup an LLC in USA and I have EIN number as well need to open USA business checking account please share me details regarding to open a bank account

Hi Livendra,

Thanks for your inquiry.

Please check your email for details on how we can help you open a US business bank account.

Happy banking!

That would be a great relief for non-resident business owner. Would you spare a few minutes to share details to my email as well? Thank you.

Hi Minh, thanks for your feedback.

As requested, check your email for details on how to open a US business bank account remotely (online).

Good luck!

We have business registration in UK,USA. We want business bank account. Now our resident India

Hi Sathiamoorthy,

Thanks for your comment.

We’d be happy to help you open a US business bank account — possibly, even remotely (without visit to American bank).

So, feel free to contact us.

Enjoy your US banking!

My company is registered in USA and has EIN number as well. Please help me with opening a business checking account in USA.

Regards

Eric

Hi Eric,

Thanks for your inquiry.

We would be happy to help you open a US business bank account.

For this purpose, feel free to contact us.

Hi. I have registered company in USA but I want to open a bank account in USA. Anyone can help me?

Hi Aravind,

Thank you for your inquiry.

We would be glad to help you open a US business (corporate) bank account.

To this end, feel free to contact us.

Hello,

We have incorporated a company in Delaware. Is it necessary to open an account in Delaware or can we open a bank account in New York?

Hi Sam,

Thanks for your inquiry.

You can open a bank account in New York.

If you need help with opening a US business bank account, feel free to contact us.

Good luck!

Hi,

I have a registered company LLC in Wyoming, earlier i had an account with Bank of America, but because the signer was different which we do not know, and they closed the account.. then I have opened the bank account with BMO Harris Bank, where I was the signer of the account, it went well but after an year they halted the account for a month now with name review..

Because of this company is going through tough situation and because we need Bank account for company..

Can you please help us to open a corporate / small banking / business account / checking account

Hi Avon,

Thanks for your inquiry.

We’d be happy to help you open a US business bank account.

We’ve already emailed you, accordingly.

Good luck with your US banking!